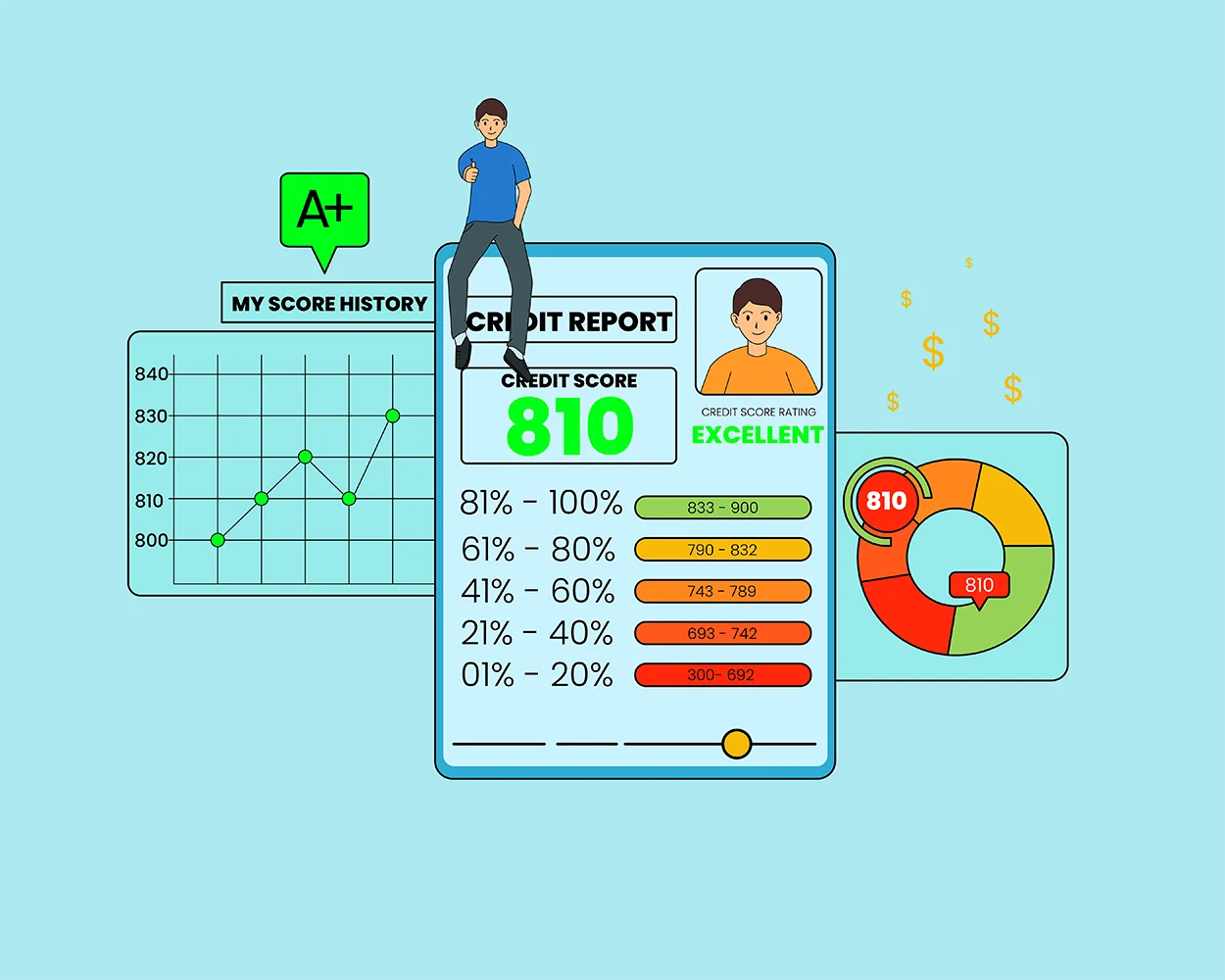

A credit repot score is the basis used by lenders to determine if your loan application will be approved or not. If your credit report score is above 700, there won’t be any problems and your loan will be granted with low interest rates. If however you score below this figure, you will be charged a higher interest rate and in the most extreme cases, they will not approve your loan application.

But how do creditors come up with this figure? Basically, they do this by reviewing credit related information such as your payment history to find out if you have ever had any late payments or filed for bankruptcy. They will also check how much money you owe not only on your credit card bill but also outstanding loans.

They will also take into account the length of your credit history. Also, a lot of people apply for new credit and a few other minor factors that could bring up or down your credit score.

What is not in your credit report scores is your color, gender, marital status, national origin and religion as this is not relevant. Creditors do not also consider if you are receiving public assistance or any consumer rights that are under the federal Equal Credit Opportunity Act or the Fair Credit Reporting Act.

You can get a copy of your credit report score so you know what where you stand. You can get this from one of three credit reporting agencies namely Experian, Equifax or Transunion. Consumers are advised to get a copy at least once a year since it changes annually.

If you credit report score is not satisfactory, you must do your best to improve it. Some of the things you can do include paying your bills on time, contacting your creditor regarding your situation so an arrangement can be made and seeing a non profit credit counselor who will help you manage your finances.

As much as possible, you must never file for bankruptcy because it will be very difficult to achieve a good standing.

When you happen to see errors in your credit report and believe that there is a mistake, you must write a letter immediately to the agency where you got this document so this can be corrected. You must state the issue and any supporting paperwork to strengthen your claim. Never send the originals so have something to hold on to and if this is sent by a courier, make sure that you get a copy of the return receipt so you can follow this up with whoever got it.

The reporting agency will then conduct an investigation by contacting your creditors. If the creditor cannot verify their entry, they have no choice but to remove this from your record and you will receive a free copy of the revised credit report score. The same goes when an error has been made and a copy of this revised version will also be sent to other credit agencies.

Now that you know what a credit report score is, it is time to find out what is your standing. This should be good at all times so you get the best deals when you have to apply for a loan to pay for college tuition, buying a car or a new home.